Major Heading Subtopics

H1: Purple Clause LC Spelled out: Ways to Safe Progress Payment In advance of Transport Through MT700 -

H2: Introduction to Purple Clause Letters of Credit - Origin of your Phrase

- Job in Pre-Shipment Financing

- Relevance in Present day Trade

H2: What exactly is a Red Clause LC? - Definition

- Key Qualities

- How It Differs from Common LCs

H2: How Red Clause Will work in Apply - Progress Payment System

- Situations for Launch of Funds

- Financial institution’s Role

H2: Crimson Clause in MT700 SWIFT Structure - Related Fields in MT700

- How the Clause is Inserted

- Sample Wording Illustration

H2: Use Cases: Who Positive aspects from the Red Clause LC? - Exporters with Restricted Performing Capital

- Agricultural and Commodity Traders

- Tiny Corporations Entering Worldwide Marketplaces

H2: Benefits of Pink Clause LCs - Access to Pre-Shipment Money

- Encourages Trade in Emerging Markets

- Speedier Output and Fulfillment

H2: Dangers Associated with Crimson Clause LCs - Misuse of Cash

- Non-Cargo Possibility

- Consumer Hesitance

H2: How Banks Mitigate Threat in Crimson Clause LC Transactions - Documentation Demands

- Collateral or Insurance Choices

- Bank Vetting Processes

H2: Legal Framework and UCP 600 Recommendations - Related UCP Articles or blog posts

- ICC Interpretation

- Authorized Enforcement

H2: Crimson Clause LC vs Eco-friendly Clause LC - What’s the main difference?

- Storage vs Creation Financing

- When to utilize Each and every Sort

H2: Phase-by-Stage: Creating a Red Clause LC - Buyer-Exporter Settlement

- Ask for to Issuing Financial institution

- Bank Review and MT700 Issuance

- Fund Disbursement

H2: Pink Clause LC within the Exporter’s Point of view - The way to Make use of the Funds Sensibly

- Guaranteeing Compliance

- Constructing Buyer Confidence

H2: Exporter Strategies to reduce Crimson Clause LC Risks - Protecting Crystal clear Conversation

- Publishing Solid Proposals

- Making use of Funds Transparently

H2: Serious-Entire world Example of a Purple Clause LC Transaction - Situation in Agriculture or Producing

- How Pre-Shipment Resources Have been Used

- Result and Payment Settlement

H2: Regularly Questioned Inquiries (FAQs) - Can the pink clause be cancelled?

- The amount of advance is often requested?

- Is collateral essential?

- Can the red clause LC be transferable?

- Are crimson clause LCs common nowadays?

- Who assumes the biggest chance?

H2: Summary - Summary of Crucial Takeaways

- When to employ a Crimson Clause LC Safely and securely

Now, I’ll begin producing the long-kind Search engine optimization short article utilizing the outline previously mentioned.

Pink Clause LC Defined: The way to Protected Progress Payment Prior to Delivery As a result of MT700

Introduction to Red Clause Letters of Credit score

On this planet of Intercontinental trade, money circulation is anything—specifically for small and mid-sized exporters. At times, they need to get more info have Doing the job cash before they're able to even ship the goods. That’s the place the Purple Clause Letter of Credit rating (LC) arrives into Engage in.

The title "Purple Clause" arises from the early follow of producing the Exclusive pre-cargo advance issue in crimson ink to make it stand out. Whilst contemporary LCs no longer use colored ink, the time period has trapped all over.

Currently, a Purple Clause LC serves being a lifeline, particularly in industries the place suppliers need to have funds upfront to source raw materials, manufacture merchandise, or take care of logistics prior to the shipment even leaves the manufacturing unit.

Exactly what is a Purple Clause LC?

A Crimson Clause LC is really a type of letter of credit history that authorizes the advising or negotiating financial institution to advance resources on the beneficiary just before the actual cargo of goods—dependant on specified terms.

Vital features contain:

Partial advance supplied just before cargo

Stability payable after delivery documents are submitted

Possibility-sharing among consumer and financial institution to market early trade execution

This causes it to be distinctive from classic LCs, where payment is simply released soon after shipping paperwork are confirmed.

How Red Clause Performs in Practice

Listed here’s the way it functions:

Purchaser difficulties LC having a purple clause included, specifying the advance phrases.

Advising lender disburses progress money on the exporter.

Exporter uses the money for production or sourcing.

At the time goods are delivered, the exporter submits the paperwork.

The lender pays the remaining LC benefit, much less the advance volume.

This set up permits suppliers to start manufacturing devoid of exterior financial loans, improving turnaround and purchase fulfillment time.

Crimson Clause in MT700 SWIFT Format

The MT700 could be the standard SWIFT message used to problem letters of credit score. When issuing a Crimson Clause LC, distinct clauses need to be Evidently mentioned in Industry 47A (Supplemental Conditions).

Example wording:

“The advising bank is authorized to progress up to twenty% with the LC amount of money into the beneficiary right before cargo, from beneficiary’s published ask for and an endeavor to repay inside the occasion of non-shipment.â€

It’s crucial to ensure clarity, conditions for the progress, and documentation demands are specified in the MT700 format to stay away from upcoming disputes.

Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Jeremy Miller Then & Now!

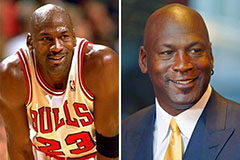

Jeremy Miller Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!